By Elric Langton & Alex Langton | 7 November 2023

Elric has a financial interest in Aptamer.

The pioneering MedTech firm specialising in synthetic antibodies developed through their exclusive Optimer technology, Aptamer Group, which recently raised £3.6 million, has reported declining revenue. The financial figures for the first half of fiscal 2022, ending December 31, reveal a 26% downturn, with revenue dropping from £1.4 million to £1 million compared to the same period of the previous year. The decline is attributed to a drop in customer confidence, highlighting the sensitivity of Aptamer’s operations to market sentiment.

Despite the fall in revenue, Aptamer’s narrative remains optimistic, of course. The new management’s strategy is gaining a foothold, focusing on cultivating and converting its pipeline into tangible outcomes.

On the frontlines of innovation, the Company reports “great progress” for its Optimer-based therapeutics, particularly in the promising fields of gene therapy and precision chemotherapy. Such advancements hint at a future ripe with potential, which is an area investors have an appetite for.

Aptamer successfully implemented enhancements that promise a leaner operation. These optimisations have yielded increased production capabilities and reduced the demand for materials from their clientele—developments that can not only refine the cost structure but also potentially enhance competitive positioning.

Cost-base reductions, achieved as of September’s end, round out the Company’s statement, suggesting a strategic trimming of expenditures. In juxtaposing fiscal prudence and scientific advancement.

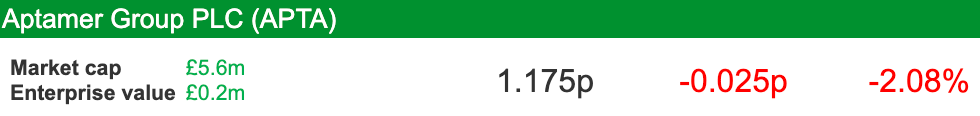

The narrative spun by Aptamer’s new management team, in place since late August, is one of tenacious turnaround. A £300k ring-fenced investment for R&D efforts illustrates a commitment to a future where cutting-edge life sciences play a leading role. Yet, the immediate backdrop is less than stellar – the share price struggles to find a firm floor-teetering on the edge of a historical new low, a stark contrast to the high hopes of technological aspirations, hence why we featured the Company as a potential recovery play recently, when the share price was 1.40p. It has slipped again yesterday and today, 11% down as I type of the two sessions, which is expected given the market will focus on the key phrase; “revenue in its first financial half will be lower due to weaker customer confidence.” This suggests the Company has to work extra hard to regain customer confidence or lose them. So, it is a brave investor to gunho now. A more cautious approach is required if one is happy with the risks as we currently know them to be.

Operational Advances Masking Revenue Gaps