Mike Caine | 1 March 2025

Myself and Elric have a financial interest in Insig AI.

OptiBiotix Health sponsors this editorial.

I was going to put that it has been a ‘rocky’ road being a shareholder in INSG, but that would imply that there have been ups and downs in the stock, since its RTO back in May of 2021 at 61p. Clearly, the share price reflects the negative history to date and the repeated disappointment of actual tangible Results. At best, a chartist could argue that the last 12 months have been a consolidating period, which often precedes a possible change of sentiment and an upward share chart. There are no guarantees of that, though.

So, where now for the Company as we approach springtime, with fund raises previously being announced in April of both 2024 and 2023? Cash in September was £200k with a £300k tax credit still due, and with just one announced contract for £80k, although there are probably smaller wins that haven’t been announced, plus a trickle from Carval, further funding must be required again?

Since the appointment of Richard Bernstein as CEO at the end of May 2024, the sentiment of existing shareholders has greatly increased, the change of sentiment being supported by Richards’ very successful activist transactions and conduit for positive change and alignment with shareholders. Within INSG, this has been supported by a regular and now long period of share buying in the open market, which by my basic rounded maths is now >£900k, this being on top of his already large holding and further supported financially during placings and loan guarantees.

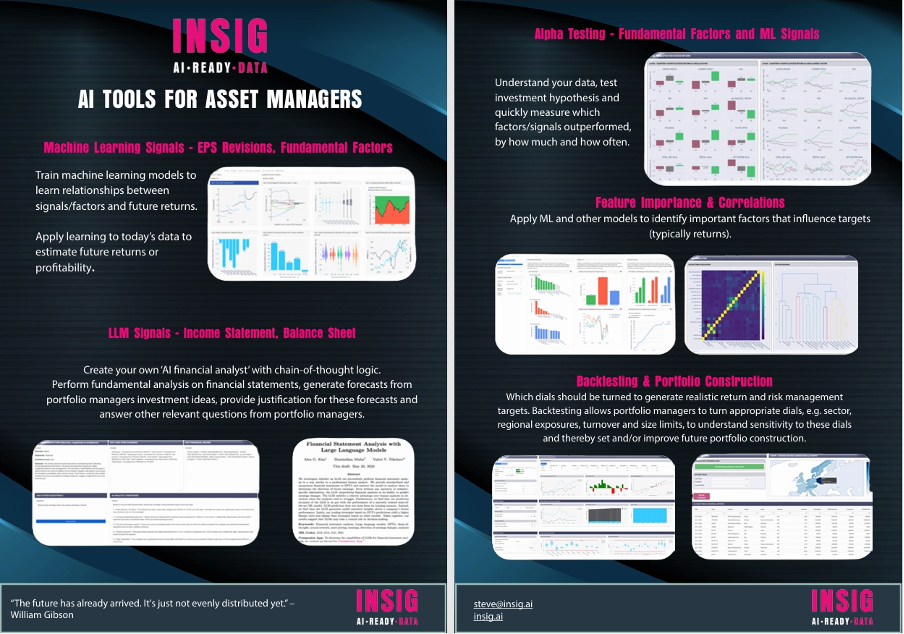

In very recent communications with the Company, I was somewhat relieved to come away thinking that things are moving forward and that there is possibly a better outlook for investors. One criticism often aimed at INSG is that it is difficult to understand what it actually does. In that vein it seems the website is being revamped (relaunched?) in much more simplistic terminology and exampling. As an example being worked on

“Our technology is designed to help businesses quickly and accurately assess corporate ESG and sustainability disclosures, saving significant time and effort compared to manual analysis.

At its core, our system scans company reports, such as annual and sustainability reports, using AI-powered search techniques. Instead of sifting through hundreds of pages, users can ask targeted questions like “Does this company have a net zero target, and if so, what is it?” The system then extracts the relevant information and provides a direct reference so it can be quickly verified.

What makes our approach unique is the combination of scale and accuracy. We can process thousands of reports and queries at once, ensuring consistency and reducing human error. The technology is also flexible, so it can be adapted to different ESG frameworks (such as CSRD) or customised for clients in legal, procurement, or investment roles.

Ultimately, this means organisations can efficiently analyse corporate disclosures, identify gaps, and make informed decisions with greater confidence without spending countless hours on manual research.’’

Clearly, CSRD is going to be an expensive and time-consuming requirement, which is where INSG can make a huge difference.

I am expecting investor communication to increase significantly at some point. Currently, it is thought these would be mainly futile until a number of business wins have been announced. This sounds really positive to me and coupled with the growing ‘pipeline’, although from a low base, leads me to believe contract news could be forthcoming.

I have to mention Diginex, now nearly valued at $1.5 billion and with similar Revenues to INSG (£17M). As well as a dual listing on both NASDAQ and now Frankfurt, it was announced last week that it is relocating its main office functions to London. I have researched as best I can, and admit to now abandoning trying to work the valuation out, however, it seems its offering is currently weak (when compared to INSG). It has also mentioned –

‘’ Diginex Limited's Chief Executive Officer, Mark Blick, will relocate to London to lead the Company's expansion in the region. The Company's executive leadership team comprises of six senior leaders, including four British executives, one German, and one Swiss. The Company plans to hire additional senior executives in London to further support its growing operations and drive strategic initiatives. This decision strengthens Diginex Limited's leadership presence in the European market, which has become an increasingly important region for its growth strategy. With this shift, Diginex Limited expects to be better positioned to intensify its focus on mergers and acquisitions across Europe and the United States, allowing key executives to be closer to potential M&A target companies and emerging opportunities.’’

Diginex Limited Announces Relocation of Headquarters to London as Cornerstone for Global Expansion

As before, I expect any funding concerns will be addressed positively. Whilst many may say that most of this article is as ‘’we’ve heard it all before’’, I would refer that the CEO clearly stated, “I have a clear path as to how the coming weeks and months should play out.’’ With his previous success’ who would argue against?

Opinions

We do not offer advice or solicit the purchase of shares in any companies we discuss. However, share values fluctuate, making your financial situation risky.

The views and opinions contained within these editorials are for research purposes and are the opinions of the author(s). We aim to be as accurate as possible but stress you should also perform your research and never act solely on the contents of these editorials.

Sorry for the edit error, Mike.

The Word doc had a significant gap, which resulted in a blank page. I have resolved this. Please see the update. It now makes more sense.

PJ,

Thanks for the editorial

As you know I’m personally not one for having “chit chats” with CEO’s (although they can be of some comfort)

I prefer CEO’s who get themselves “out there” in front of camera via interviews and podcasts or via investor meets

I’m not saying this way is perfect as you do get the glib ones who talk the talk (or blarney as the case may be) 😜 and are normally very lacking in actual substance but at least we can see the body language and watch them answer questions put to them by shareholders

I’m sure RB is as genuine as they come but on the face of it from what little private punters know we are not much further on down the road than we were years ago.

We may well be miles ahead of the competition but we don’t know do we as we are told very little

RB may well have purchased loads of shares so what? He’s been buying for years and we are still struggling to hold just middle teens pence wise.

No amount of talk can alter the fact that this company since inception has been a serial failure with its own in house predictions and promises that every share holder if they care to look can read.

RNS’s about £80k contracts are an embarrassment

I suspect we are due a fund raise very soon, I hope we get good contact news very soon

However as the past is a guide to the future I can only hope for the latter and I’m pretty certain about the former

Only in my opinion